Why a Roth IRA is a bad idea?

A key benefit of traditional and Roth IRAs is that you are not required to pay any type of capital gains tax on investments. … One thing to keep in mind, however, is that your traditional IRA disbursements will be taxed as normal income.

Can a Roth IRA make you a millionaire?

Contents

- 1 Can a Roth IRA make you a millionaire?

- 2 At what age does a Roth IRA not make sense?

- 3 Is a Roth IRA good for seniors?

- 4 Can a Roth IRA fail?

- 5 What is a backdoor Roth?

Fully fund a Roth IRA each year, build a diversified portfolio, and you can become a millionaire in time to retire. As long as you start early enough.

How much do you have to contribute to a Roth IRA to be a Millionaire? Start Saving Early If you contribute $6,000 to an Individual Retirement Account (IRA) every year ($500 per month) for 40 years, your total investment would be $240,000. But, due to compounding power, your investment would increase to over $1.37 million, assuming a 7% return.

Can Roth IRA make you rich?

You can hit the million dollar mark if you start early, contribute consistently, and invest in high-quality assets. For example, if you commit to contributing $6,000 to a Roth IRA every year for 40 years, you can turn $240,000 into over $1 million.

Can you get rich from a Roth IRA?

Some ultra-rich individuals have amassed hundreds of millions — or even billions — of dollars in individual Roth tax-free retirement accounts, according to a report released Thursday by ProPublica, an investigative news outlet.

Is Roth IRA good for high income?

High-income people can use this tax-friendly strategy to save for retirement. This year, savers can save up to $5,500 on a Roth IRA. Those aged 50 and over can contribute up to $6,500. … A strategy that allows high-income earners to hide money in a Roth IRA is still in play.

At what age does a Roth IRA not make sense?

Obviously, younger ones don’t have to worry about the 5-year rule. But if you open your first Roth IRA at age 63, try to wait until you’re 68 or older to withdraw any earnings. You do not need to contribute to the account in each of these five years to pass the five-year test.

At what age should I stop contributing to my Roth IRA? You cannot deduct contributions to a Roth IRA. If you meet the requirements, eligible distributions will be tax free. You can make contributions to your Roth IRA after reaching the age of 70 and a half. You can leave valuables in your Roth IRA as long as you live.

Is a Roth IRA good for seniors?

There are no age limits for Roth IRA contributions. … Unlike the traditional IRA, where contributions are not allowed after age 70 and a half, you are never too old to open a Roth IRA. As long as you’re still making money and breathing, the IRS is fine with you opening and financing a Roth.

Can a 72 year old contribute to a Roth IRA?

At age 72, a worker must begin receiving the required minimum distributions from their retirement accounts. … Workers over age 72 can still contribute to an IRA, a 401(k) and other retirement accounts, depending on their specific circumstances.

How much can a 65 year old contribute to a Roth IRA?

The maximum you can contribute to all of your Traditional and Roth IRAs is the lesser of: For 2020, $6,000 or $7,000 if you are 50 or older by the end of the year; or. your taxable compensation for the year. For 2021, $6,000 or $7,000 if you are 50 or older by the end of the year; or.

Can I start a Roth IRA at age 70?

There is no age restriction for contributions to Roth IRAs. You can now make contributions to traditional IRAs beyond the previous age limit of 70 and a half, thanks to the SECURE Act.

How much can a 70 year old contribute to a Roth IRA?

The maximum you can contribute to all of your Traditional and Roth IRAs is the lesser of: For 2020, $6,000 or $7,000 if you are 50 or older by the end of the year; or. your taxable compensation for the year. For 2021, $6,000 or $7,000 if you are 50 or older by the end of the year; or.

Can seniors contribute to Roth IRA?

Retirees can continue to contribute earned funds to a Roth IRA indefinitely. You cannot contribute an amount that exceeds your earnings and can only contribute up to the annual contribution limits set by the IRS. People with traditional IRAs should start making the required minimum distributions when they reach 72.

Who should not convert to a Roth IRA?

If you’re less than five years away from retirement, it probably doesn’t make sense to convert to a Roth IRA. A Roth conversion will trigger taxes, so you must be willing and able to pay those taxes.

When would you not want a Roth IRA?

Roth IRA contributions from single registrars are prohibited if your income is $140,000 or more in 2021. The income elimination range for singles is $125,000 to $140,000. Individual contributors cannot contribute to a Roth in 2022 if they earn $144,000 or more. Your contribution is reduced if you earn between $129,000 and $144,000.

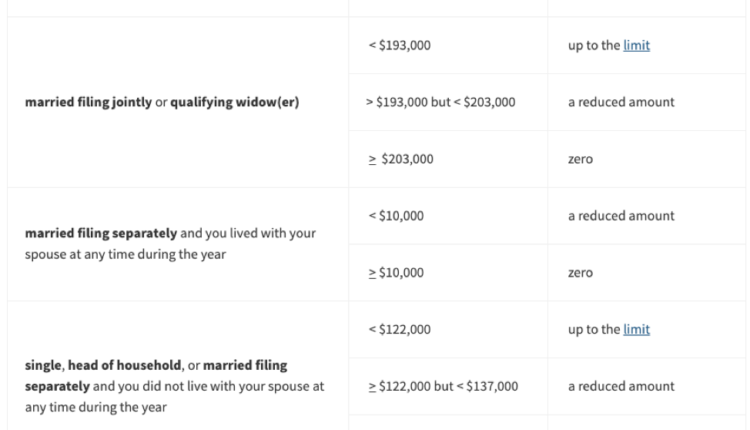

Who should not contribute to a Roth IRA?

You cannot contribute at all if your MAGI exceeds the limits. 3 The IRS updates the Roth IRA income limits every year to account for inflation and other changes. Separately married record and head of household filers can use the limits for single people if they did not live with their spouse in the previous year.

Is a Roth IRA good for seniors?

There are no age limits for Roth IRA contributions. … Unlike the traditional IRA, where contributions are not allowed after age 70 and a half, you are never too old to open a Roth IRA. As long as you’re still making money and breathing, the IRS is fine with you opening and financing a Roth.

How much can a 65 year old contribute to a Roth IRA? The maximum you can contribute to all of your Traditional and Roth IRAs is the lesser of: For 2020, $6,000 or $7,000 if you are 50 or older by the end of the year; or. your taxable compensation for the year. For 2021, $6,000 or $7,000 if you are 50 or older by the end of the year; or.

How much can a 70 year old contribute to a Roth IRA?

More on 401(k) Note: For other 401(k) contribution limits, see Retirement Topics – Contribution Limits. For 2022, 2021, 2020, and 2019, the total contributions you make each year to all of your Traditional IRAs and Roth IRAs cannot be more than: $6,000 ($7,000 if you are 50 or older), or.

What happens if you contribute to a Roth IRA and you are over the income limit?

The IRS will charge a penalty of 6% of the excess amount for each year that you do not take action to correct the error. For example, if you contributed $1,000 more than allowed, you owe $60 each year until you correct the mistake.

How much income is too much to contribute to a Roth IRA?

Contributions to Roth IRAs are limited and can be eliminated depending on how much income you earn and your tax return status. For those who report their taxes as single, contributions cannot be made to a Roth if their income exceeds $139,000 in 2020 and exceeds $140,000 in 2021.

Can a 72 year old contribute to a Roth IRA?

At age 72, a worker must begin receiving the required minimum distributions from their retirement accounts. … Workers over age 72 can still contribute to an IRA, a 401(k) and other retirement accounts, depending on their specific circumstances.

Can seniors contribute to Roth IRA?

Retirees can continue to contribute earned funds to a Roth IRA indefinitely. You cannot contribute an amount that exceeds your earnings and can only contribute up to the annual contribution limits set by the IRS. People with traditional IRAs should start making the required minimum distributions when they reach 72.

Can a 73 year old contribute to a Roth IRA?

Who can contribute to a Roth IRA? Roth IRA contributions are allowed with no age limit, as long as an older individual has earnings from employment and does not exceed the earnings limit.

Can a Roth IRA fail?

The five-year rule applies in three situations: if you withdraw earnings from the account, if you convert a traditional IRA into a Roth, and if a beneficiary inherits a Roth IRA. Failure to comply with the five-year rule can result in the payment of income tax on profit withdrawals and a 10% penalty.

Can you lose all your money on a Roth IRA? Yes, you can lose money on a Roth IRA. The most common causes of a loss include: negative market fluctuations, early withdrawal penalties, and insufficient time to increase. The good news is that the longer you allow a Roth IRA to grow, the less likely you are to lose money.

Is a Roth IRA guaranteed return?

Roth IRA contributions are limited to $6,000 per year or $7,000 if you are 50 years or older. This limit does not apply to life insurance premiums. … There is no risk of loss with the cash value of a life insurance policy, and you usually have a guaranteed minimum annual return on your money.

Is a Roth IRA guaranteed to make money?

The Roth IRA provides tax-free growth and tax-free retirement withdrawals. Roth IRAs grow through composition, even during the years when you cannot make a contribution. There are no RMDs, so you can leave your money alone to keep growing if you don’t need it.

What is the average return on a Roth IRA?

There are several factors that will impact how your money grows in a Roth IRA, including how diverse your portfolio is, your timetable for retiring, and your risk tolerance. That said, Roth IRA accounts have historically delivered average annual returns between 7% and 10%.

Is my money safe in a Roth IRA?

Your investments are protected up to these limits from any broker mishandling, although market risks still apply to stocks, bonds, funds and other assets. The limit applies separately to any joint accounts an individual may have with a spouse, although Roth IRAs, by definition, can only be held by individuals.

Can you take losses in a Roth IRA?

The Internal Revenue Service does not allow you to deduct losses from your Roth IRA year after year, so the only way to deduct your losses is to close your Roth IRA accounts.

Can you lose all your money in an IRA?

The most likely way to lose all the money in your IRA is to have your entire account balance invested in an individual stock or bond investment, and that investment becomes worthless due to the company’s bankruptcy. You can avoid a total IRA loss scenario like this by diversifying your account.

What is a backdoor Roth?

A Roth IRA backdoor is not an official type of individual retirement account. Rather, it is an informal name for a complicated Internal Revenue Service (IRS) sanctioned method for high-income taxpayers to fund a Roth, even if their income exceeds the limits the IRS allows for regular Roth contributions.

Is the Roth backdoor still allowed in 2021? Individual filers with Modified Adjusted Gross Income (MAGI) for 2021 of $140,000 or more, or $208,000 for couples filing joint lawsuits, are barred from contributing directly to Roth IRAs – but they can still take advantage of this special account going through a ‘back door.

Is Roth backdoor legal?

Current law prohibits any contributions to Roth accounts for individual taxpayers whose annual income exceeds $140,000. However, the law allows top earners to convert funds from a pre-tax IRA – which does not have an income cap – to a Roth IRA. … (They must pay income tax on the converted funds.)

Is backdoor Roth still allowed in 2020?

You have until the federal tax filing deadline for each tax year to make IRA contributions. … If you have not yet filed your taxes for 2019, you have until April 15, 2020 to complete a Roth IRA conversion to the funds.

Is the backdoor Roth strategy legal?

Current law prohibits any contributions to Roth accounts for individual taxpayers whose annual income exceeds $140,000. (The limit is $208,000 for couples who file a joint tax return.) The House’s tax proposal would not allow conversions of IRA and 401(k) funds to a Roth account. …

What is the purpose of a backdoor Roth?

A backdoor Roth IRA is a way for people with high incomes to get around Roth income limits. Basically, a Roth Funds IRA comes down to some sophisticated administrative work: You put money into a traditional IRA, convert your contribution funds into a Roth IRA, pay some taxes, and that’s it.

What’s the point of a backdoor Roth?

A backdoor Roth IRA is a legal way to get around the income limits that normally prevent high-income people from contributing to Roths. A Roth IRA backdoor is not a tax evasion – in fact, it may even incur higher taxes once it is established – but the investor will get the future tax savings from a Roth account.

Is a backdoor Roth a good idea?

If your federal income tax bracket is 32% or more, making a Backdoor Roth IRA is a terrible, terrible idea. It is highly unlikely that you will make more money and therefore be in a higher tax bracket in retirement! It’s nice to have tax-free money to cash out in retirement.

Is a backdoor Roth a good idea?

Backdoor Roth IRAs are worth considering for your retirement savings, especially if you have a high income. A Backdoor Roth conversion may be something to consider if: You have already reached the limit of other retirement savings options. They are willing to leave their money on Roth for at least five years (preferably longer!)

Is the Backdoor Roth IRA going away?

Starting in 2022, the bill proposes an end to non-deductible backdoor calls and Roth backdoor megaconversions. Regardless of income level, you will no longer be able to convert after-tax contributions made in a 401(k) or traditional IRA to a Roth IRA.

Do you pay taxes on a backdoor Roth?

A Roth IRA backdoor is not a tax evasion – in fact, it may even incur higher taxes once it is established – but the investor will get the future tax savings from a Roth account.

Comments are closed.