What is the average FERS pension?

How much does a GS 13 make in retirement?

Contents

- 1 How much does a GS 13 make in retirement?

- 2 Does TSP still grow after retirement?

- 3 How much should I have in my TSP at 60?

- 4 What is the difference between TSP and FERS?

- 5 Is FERS an annuity or pension?

- 6 Can I retire from the federal government after 10 years?

If he retires with 30 years of service, the FERS basic pension will give him 30 percent of the average high salary. It has been at the GS 13-10 level for three years now.

How long does it take to get from GS 13 to GS 14? To qualify for a GS-14 level position, you must have at least one year of GS-13 level experience. Depending on the position, candidates may be able to substitute education for any of the required experiences.

How do I calculate my GS retirement pay?

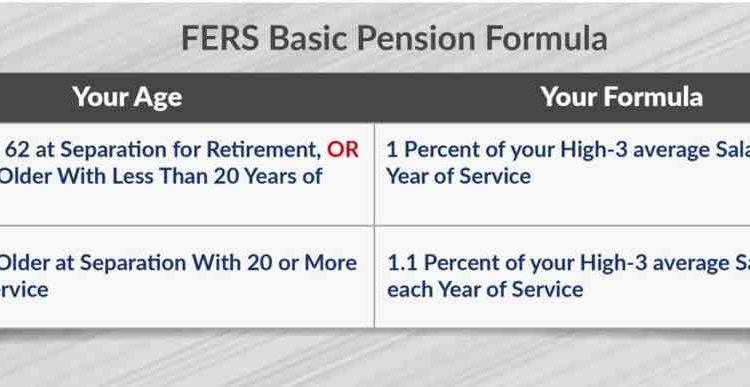

In general, the benefit is calculated as 1 percent of the average high-3 salary multiplied by years of service. For those retiring at age 62 or later with at least 20 years of service, a factor of 1.1 percent is used instead of 1 percent.

How does high 3 work for federal retirement?

Your high 3 salary is an important part of calculating your federal pension. Your high 3 salary is the highest average base salary you have earned during any 3 consecutive years of federal service. You should also know that your high 3 salary is calculated based on three * consecutive * years, NOT a calendar year.

Does FERS high 3 include locality pay?

So, does FERS include a local payment in your annuity? Yes, place salary adjustment is included as part of your base salary when calculating your annuity. After retirement there is no adjustment about where you live.

How much does a GS 15 make in retirement?

It depends on whether he retired from the civil service or the federal retirement system. At the age of 33, GS 15 ended up close to a salary of 150,000 dollars. The CS program could give him 85% of his average high three-year salary.

What is the average retirement income?

| Household age | Median Income | Mean Income |

|---|---|---|

| Households aged 60-64 years | $ 64,846 | $ 91,543 |

| Households aged 65-69 years | $ 53,951 | $ 79,661 |

| Households aged 70-74 | $ 50,840 | $ 73,028 |

| Households aged 75 and over | $ 34,925 | $ 54,416 |

How much money does a GS 15 make?

The starting salary for an employee in GS-15 is $ 110,460.00 per year in step 1, with a maximum possible base salary of $ 143,598.00 per year in step 10. The base hourly wage for an employee in step 1 of GS-15 is $ 52.93 per satu1. The table on this page shows the basic pay rates for a GS-15 employee.

What is the average pension of a federal employee?

The defined FERS benefits are lower – an average of about $ 1,600 per month and a median of about $ 1,300, for annual figures of $ 19,200 and $ 15,600 – because the program also includes social security as a basic element.

How much pension do government employees get?

The amount of the pension is 50% of the income or average salary, whichever is useful. The minimum pension is currently Rs. 9000 per month. The maximum pension limit is 50% of the highest salary in the Government of India (currently Rs.

How many years do you have to work to get federal pension?

You must have worked in the federal government for at least 5 years before you qualify for the FERS federal pension, and for each year you work, you will be entitled to at least 1% of your average 3-year salary. Automatic deductions that can range from.

Does TSP still grow after retirement?

Depending on when you start retiring, you can simply leave the money in the TSP and let it continue to grow. If you don’t have to access it yet, it might be wise to let it go. Similar to other retirement accounts, you will need to start with minimum payments at age 72. This is called the required minimum distribution (RMD).

What is the average balance of TSP at retirement?

How much will my TSP be taxed when I retire?

If a traditional TSP account holder chooses to accept an eligible rollover distribution directly to the account holder, then the TSP must retain 20 percent of the federal income tax even if the account owner plans to switch the distribution to another eligible pension plan or traditional IRA.

Is TSP taxed at retirement?

Anything you withdraw from your traditional TSP is fully taxed at your usual income rate. If your Roth withdrawals are eligible, nothing you take from the Roth portion of your account is taxable.

How does TSP work when you retire?

You can get a fixed amount in dollars from your TSP each month in retirement. The money is deducted from your TSP pension account, and withdrawals will continue as long as your money lasts. … Benefits – You get a predictable monthly income as long as your money lasts.

How long can you leave your money in TSP?

If you have any TSP loans, repay them within 90 days of your divorce. Read Withdrawing your TSP account after leaving the Federal Service to fully understand your options.

How long can you keep your money in TSP?

Your payments will continue unless you stop them until your account balance is zero. This is true even if you choose to make payments first from your traditional balance or first from your Roth balance.

Can you leave your money in TSP after retirement?

Depending on when you start retiring, you can simply leave the money in the TSP and let it continue to grow. … Similar to other retirement accounts, you will have to start with minimum payments at age 72. This is called the required minimum distribution (RMD).

Is TSP a good retirement plan?

For federal employees, participating in a Thrift Savings Plan can greatly increase your chances of financial security in retirement, but some people you work with don’t make the most of their TSP.

Is TSP the best investment?

TSP is considered one of the best, most supervised and cheapest funds in the business. But many people believe it lacks flexibility and doesn’t offer as many investment choices as most outside plans.

How many TSP is a millionaire?

The good news: There are 98,879 federal TSP millionaires! The bad news: Too many people know it! The number of federal / postal workers who have become millionaires of the Thrift Savings Plan has risen sharply in recent years.

How much should I have in my TSP at 60?

To retire at age 67, experts from pension plan provider Fidelity Investments say you should have eight times the income saved by age 60. You’re not the only one behind.

How much does the average 60-year-old have retirement savings? If you are approaching the age of 60, you are probably thinking of retirement. Have you saved enough? How much does the average 60-year-old have retirement savings? According to the Federal Reserve, for people aged 55 to 64, that number is just over $ 408,000.

How much savings should I have at 60?

To have a comfortable retirement lifestyle, a 60-year-old should save at least 15 times his annual expenses. … In other words, if you spend $ 50,000 a year, you should have at least $ 1,250,000 in savings or liquid net worth by age 60 to live comfortably in retirement.

How much does the average 60 year old have in retirement savings?

Americans in their 30s: $ 45,000. Americans in their 40s: $ 63,000. Americans in their 50s: $ 117,000. Americans in their 60s: $ 172,000.

What is the average net worth of a 60 year old?

According to the Fed, the average net worth of Americans in the late ’60s and early’ 70s is $ 266,400. The average (or mean) net worth for this age group is $ 1,217,700, but given that averages tend to be higher due to households with high net worth, the median is a much more representative amount.

What is the average net worth of a 60 year old?

The average net worth of a 60-year-old in America is about $ 200,000. However, the above-average 60-year-old who is very focused on his finances has an average net worth closer to $ 2,000,000.

What is the difference between TSP and FERS?

The Savings Plan (TSP) is a special account for federal employees. … Your TSP contributions are optional and separate from your FERS pension. Many FERS qualify for a TSP match – where the government and your agency contribute money to your TSP account.

What is the basic benefit of FERS? The FERS Basic Benefits Plan is a defined benefit plan for federal employees that allows you and your agency to pay part of your salary today into a plan that will pay you a monthly pension when you retire, provided, of course, you meet the requirements of participation rules plan.

Is TSP part of FERS?

FERS is a pension plan that provides benefits from three different sources: the basic benefits plan, the social security plan, and the thrift savings plan (TSP). Two of the three parts of FERS (Social Security and TSP) can go with you to your next job if you leave the federal government before retiring.

Is a TSP a qualified retirement plan?

CSRS, FERS and TSP annuities are considered as eligible pension plans.

What type of account is TSP?

The Savings Plan (TSP) is a retirement savings and investment plan for federal employees and members of the uniformed services, including the Ready Reserve.

What is the average FERS pension?

The defined FERS benefits are lower – an average of about $ 1,600 per month and a median of about $ 1,300, for annual figures of $ 19,200 and $ 15,600 – because the program also includes social security as a basic element.

Is FERS pension for life?

FERS is a pension plan that provides benefits from three different sources: the basic benefits plan, the social security plan, and the thrift savings plan (TSP). … Then, after you retire, you receive an annuity every month for the rest of your life.

How long does FERS pension last?

After retirement, you are entitled to a lifetime monthly annuity. If you leave the federal service before you reach full retirement age and have a minimum of 5 years of FERS service, you can choose deferred retirement.

Is FERS retirement the same as TSP?

If you are covered by the Federal Employee Retirement System (FERS), the TSP is part of a three-part pension package that also includes your FERS basic annuity and social security.

Do federal employees get pension and TSP?

Employees under FERS receive a pension from three sources: the basic benefit plan, social security and the savings plan (TSP).

How many years does it take to be vested in FERS?

To be eligible (fulfilling the right to receive pension benefits from the basic benefit plan if you leave the federal service before retiring), you must have at least 5 years of deserving civil service. Survival and disability benefits are available after 18 months of civil service.

Is FERS an annuity or pension?

The Federal Retirement System (FERS) includes FERS employees who receive a pension from three sources: the FERS basic annuity, social security, and a savings plan. given the basic annuity figures and the reduction in survivors.

Does FERS have a pension? In each pay period, the government takes a small portion of your pension salary at FERS. For most FERS, this is 0.8% of your base salary. But your pension is not based on this amount. Your FERS pension is a defined benefit program.

Is FERS annuity monthly or yearly?

Your FERS annuity is, in short, the pension you receive from the Federal Employee Retirement System. After you retire, you will receive monthly annuities from the state for the rest of your life.

Is FERS annuity annual?

Your annual annuity is 60% of your average “high 3” salary. Your monthly rate is reduced by 100% of your monthly social security for each month in which you are entitled to disability social security. Your annual annuity is 40% of your average “high 3” salary.

When should I expect my first FERS annuity payment?

OPM attempts to approve interim payments within 10 days of receiving your pension package. The ideal schedule would be to receive your first interim payment within three to four weeks after you retire, amounting to about 80 percent of the rough estimate of your actual entitlement.

Is FERS a lifetime annuity?

The right to retire at FERS is based on years of service and the minimum retirement age (MRA). … After retirement you are entitled to a lifetime monthly annuity. If you leave the federal service before you reach full retirement age and have a minimum of 5 years of FERS service, you can choose deferred retirement.

How long does the FERS supplement last?

This allowance is paid to those FERS federal employees who retire before the age of 62 and will receive it until the month they turn 62. So, if someone retires at the age of 57, then they will receive the FERS allowance for 5 years, while at the age of 61, the pensioner will receive the benefit for only 1 year.

Is FERS a lifetime benefit?

FERS is a pension plan that provides benefits from three different sources: the basic benefits plan, the social security plan, and the thrift savings plan (TSP). … Then, after you retire, you receive an annuity every month for the rest of your life.

Is FERS annuity monthly?

FERS Annuity Supplement This is the money you are paid each month until you are 62 years old. It is the equivalent of the social assistance you earned while you were an employee of the federal government.

How is FERS monthly annuity calculated?

FERS annuities are based on an average salary of 3 to 3 years. In general, the benefit is calculated as 1 percent of the average high-3 salary multiplied by years of service. For those retiring at age 62 or later with at least 20 years of service, a factor of 1.1 percent is used instead of 1 percent.

What is the average FERS annuity?

The defined FERS benefits are lower – an average of about $ 1,600 per month and a median of about $ 1,300, for annual figures of $ 19,200 and $ 15,600 – because the program also includes social security as a basic element.

Can I retire from the federal government after 10 years?

Under the MRA + 10 option, it only takes 10 years of service to qualify for a current pension if you are under the age of 62 (but you must be at least on your MRA at the time of your separation from federal service).

What happens to the federal pension if you resign? Since FERS employees are covered by social security, when they apply for social security, those years will be counted together with those they earned outside employment. In that respect, nothing is lost by leaving power.

What happens if I leave federal service before retirement age?

If you leave your government job before you become entitled to a pension: you can ask for your pension contributions to be refunded in a lump sum, or. if you have at least five years of service, you can wait until you reach retirement age to apply for a monthly pension payment.

Can I retire at 55 under FERS?

A full, undiminished FERS annuity can be taken at age 50 with 25 years of service or at age 55 with 20 years. FERS employees who retire under these special provisions may use a different multiplier in the retirement calculation: 1.7% for the first 20 years of service and 1% for each subsequent service.

Can I retire early under FERS?

It is possible to retire early from the state with only 10 years of service. … Among them is a unique option within the Federal Employee Retirement System that allows a worker to retire at the minimum retirement age with only 10 years of service.

How many years do you have to work for federal retirement?

You must have worked in the federal government for at least 5 years before you qualify for the FERS federal pension, and for each year you work, you will be entitled to at least 1% of your average 3-year salary.

Can I get pension after 5 years?

This usually means that if you leave your job in five years or less, you lose all your pensions. But if you leave after five years, you get 100% of your promised benefits. Graded vesting. With this type of entitlement, you are at least entitled to a 20% benefit if you leave after three years.

What is the average federal employee retirement?

The average federal civil servant who retired in fiscal 2016 was 61.5 years and 26.8 years of federal service. The average monthly payment to workers who retired from CSRS in 2018 is $ 4,973. Workers who retired under FERS earned an average monthly income of $ 1,834.

Comments are closed.