How long does FERS retirement last?

Federal employees sometimes forget that their federal retirement pension * is taxable. Your CSRS or FERS pension is taxed at ordinary income tax rates. Now – you get your contributions tax free (because you already paid taxes on the money when it was taken out of your paycheck).

Can I collect 2 federal pensions?

Contents

- 1 Can I collect 2 federal pensions?

- 2 Can you lose your FERS retirement?

- 3 What day of the month do FERS retirees get paid?

- 4 How much of my retirement is taxable?

- 5 Can you collect Social Security and a pension at the same time?

Federal pension, military pension The general rule is that a retired military member who takes a federal job cannot receive both military pension and federal pension pay for the same period. You may not be paid twice for the same year of service.

Is FERS pension for life? FERS is a retirement plan that offers benefits from three different sources: a Basic Benefit Plan, Social Security and the Thrift Savings Plan (TSP). … Then, after retirement, you will receive monthly pension payments for the rest of your life.

Can you double dip retirement?

Double dipping can occur in the pension system if a civil servant continues in the same job (through a retirement process, then re-employed) while receiving pension benefits from that job. This can cause people to get pension payments and regular payments from the same government source.

Can I collect 2 pensions?

There is nothing to prevent you from receiving both a pension and a social security benefit. But there are some types of pensions that reduce social security payments.

When can you double dip on Social Security?

A person whose full retirement age is 67 can still start Social Security at the age of 62. ‘because of the low income level involved!)

Can you collect Social Security and teacher retirement?

TRSL members (except Plan B members) do not participate in Social Security, so they are not eligible for Social Security benefits through their TRSL covered employment. However, some members may be eligible for Social Security benefits through their husbands or from another job in which they have been paid into Social Security.

Can a teacher get retirement and Social Security?

By law, retired educators are not allowed to collect Social Security benefits even though many have paid into the system. … When Giammona retired as a teacher in California, she did not know that she would collect only a small portion of the Social Security benefits she was paid for before entering education.

Can you collect Social Security and strs at the same time?

Social Security is a federal program, and neither CalSTRS nor the State of California has control over claims claims or benefit calculations. These rules only affect your Social Security benefits.

What is the average federal pension?

Retirement – Less than one-third (31%) of Americans today return with a defined benefit retirement plan. For those retiring with a retirement plan, the median annual retirement benefit is $ 9,262 for a private pension, $ 22,172 for a federal government pension, and $ 24,592 for a railroad pension.

What is the average pension of a federal employee?

The average civilian federal employee retired in FY 2016 was 61.5 years old and had completed 26.8 years of federal service. The average monthly pension payment to workers retired under CSRS in FY 2018 was $ 4,973. Workers who retired under FERS received an average monthly income of $ 1,834.

What is a normal pension amount?

The median private pension benefit for individuals age 65 and older was $ 10,788 per year. The median state or local government pension benefit was $ 22,662 per year.

Can you lose your FERS retirement?

The short answer is no. Unfortunately, the misconception is that you could lose your federal pension if you are fired, even among federal employees. Many employees mistakenly believe that they will lose their federal retirement benefits if the agency fires them.

How long will the FERS pension last? After retirement, you are entitled to a monthly annuity for life. If you leave the federal service before you reach full retirement age and have a minimum of 5 years of FERS service, you may choose to take out a deferred pension.

Is FERS pension safe?

Most, if not all, of the White House proposals to build or develop the Functional Retirement System and the Federal Employees Retirement System will likely break down and burn down on Capitol Hill.

Can a federal retiree lose their pension?

Under the “Hiss Act,” members of Congress and federal employees will waive their entire retirement annuity by federal officials if convicted of a federal crime related to espionage, treason, sabotage, or any other national security insult against the United States. .

Does a federal employee lose their pension if they are fired?

To be clear, federal employees who are fired from the Federal Service (“fired”) usually do not lose the right to pension benefits already earned (accumulated), with limited exceptions (see, 5 USC 8312).

Are federal pensions safe?

“Vested” pension assets – those that become your property after a period of time – are generally safe thanks to federal law. … Pensions of civil servants are not covered by the agency, but are often protected by state constitutions or laws.

What day of the month do FERS retirees get paid?

Retirement and annuity pay is on the first of the month. However, if the former falls on a weekend or holiday, pensions will be paid on the last working day of the previous month and annuities paid on the first working day of the month. For example, the pension payment for December 2020 will be paid on 31 December 2020.

How long does it take to get your first FERS pension check? How long before I receive my first pension check? In my experience, most federal employees do not receive their first retirement check until 3 months after they retire.

When should I expect my first FERS annuity payment?

OPM will try to make a payment within 10 days of receiving your pension package. The ideal schedule would be to get you your first installment within three to four weeks of retirement, in an amount of about 80 percent of a rough estimate of your current entitlement.

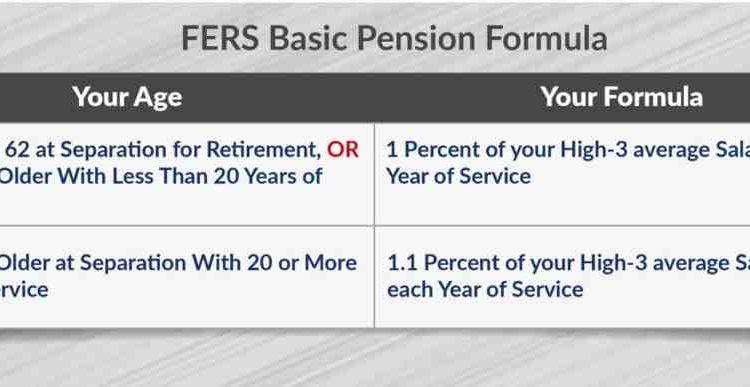

How is FERS annuity paid out?

FERS annuities are based on high-3 average pay, which is the highest average base salary you have earned during all three consecutive years of work. Generally, a federal employee’s high-3 pay is the amount they have earned in their last three years of employment.

Is FERS annuity paid monthly?

Your FERS annuity is short, the pension you receive from the Federal Employee Retirement System. After you retire, you will receive monthly government pension payments for the rest of your life.

How often is FERS annuity paid?

FERS Annuity Supplement These are money paid to you each month until age 62. It is the equivalent of the Social Security benefit you earn while employed by a federal government.

What is the average FERS annuity?

The FERS defined benefits are smaller – an average of about $ 1,600 monthly and a median of about $ 1,300, for annual figures of $ 19,200 and $ 15,600 – because this program also includes Social Security as a basic element.

How often do federal retirees get paid?

Military Retirement Paydays are always on the 1st day of the month, unless the first day is a holiday or weekend. In these cases, the payment date is the first working day before the holiday or weekend, which falls on the 1st of the month.

Will federal retirees get a raise in 2021?

The robust increase, announced by the Social Security Administration on October 13, reverses the last few years of consistent decline in the COLA increase, which has reached a minimum of 1.3 percent for 2021. a 4.9 percent increase, due to legal caps on FERS COLAs.

Are federal retirees getting an increase?

Federal pensioners see record high cost of living for Social Security. The cost of living adjustment for recipients of social security and supplementary security income will increase by 5.9 percent by 2022, marking the largest increase since 1982.

Will federal retirees get a cost-of-living increase in 2022?

The Social Security Administration (SSA) announced on October 13, 2021 that the annual Social Security cost adjustment (COLA) will be 5.9 percent in 2022 – this is the largest increase in benefit payments since 1982, when COLA was 8.7 percent .

How much of my retirement is taxable?

| COMBINED INCOME | Taxable part of Social Security |

|---|---|

| Individual Return | |

| $ 0 to $ 24,999 | No tax |

| $ 25,000 to $ 34,000 | Up to 50% of SS may be taxable |

| More than $ 34,000 | Up to 85% of SS may be taxable |

Do I have to pay taxes on my pension income? You must pay income tax on your pension and on deduction of all taxable investments – such as traditional IRAs, 401 (k) s, 403 (b) s and similar retirement plans, and tax-deferred annuities – in the year you take the money.

How do I determine my tax rate in retirement?

Calculate your tax rate Your tax rate on your pension depends on the total amount of your taxable income and your deduction. List each type of income and how much will be taxable to estimate your tax rate. Add to that, then reduce that number by your expected deduction for the year.

What is my retirement income tax rate?

Once your employer has funded your retirement plan, your retirement income is taxable. Both your income from these pension plans and your earned income are taxed as normal income with rates of 10-37%.

Will I be in a higher tax bracket in retirement?

Experts usually estimate that you will need about 70-80% of your pre-retirement income in retirement, but you will need even less depending on your situation. … If your income goes down enough, you can retire to a lower tax bracket. But even if you retire in the same tax bracket, your effective tax rate may be lower.

Can you collect Social Security and a pension at the same time?

Yes. There is nothing to prevent you from receiving both a pension and a social security benefit. … If your pension comes from what the Social Security calls “covered” employment, in which you have paid Social Security tax, this has no effect on your beneficiaries.

Is Social Security Reduced When You Retire? Does a pension reduce my social security benefits? In the vast majority of cases, no. If the pension is from an employer who has deducted the FICA taxes from your paychecks, as almost all of them do, it does not affect your Social Security pension benefits.

How much will my Social Security be reduced if I have a pension?

We will reduce your social security benefits by two thirds of your state pension. In other words, if you receive a monthly civil service pension of $ 600, two-thirds of that, or $ 400, must be deducted from your Social Security benefits.

Can you collect Social Security and a pension at the same time?

Yes. There is nothing to prevent you from receiving both a pension and a social security benefit. … If your pension comes from what the Social Security calls “covered” employment, in which you have paid social security benefits, this will not affect your benefits.

What income will reduce Social Security benefits?

If you are younger than the full retirement age and earn more than the annual income limit, we can reduce your benefit amount. If you are under full retirement age for the entire year, we will deduct $ 1 from your benefit payments for every $ 2 you earn above the annual limit. For 2021, this limit is $ 18,960.

Can you draw Social Security and state retirement at the same time?

When you retire, you will receive your public pension, but it does not count towards your full social security benefit. Under federal law, any Social Security benefits you earned are deducted if you were a federal, state, or local employee who earned a pension on wages that were not covered by Social Security.

What is the maximum amount of Social Security retirement you can draw?

What is the maximum social security benefit? The most an individual who can receive a claim for Social Security Retirement Benefits in 2021 per month is: $ 3,895 for someone who files at age 70.

Can you get Social Security and retirement at the same time?

You can receive Social Security pension benefits while working before reaching your full retirement age. However, your benefits will be reduced if you earn more than the annual income limit. … Once you reach full retirement age, your income will not be affected by any benefit.

Does a pension count as earned income?

For the year you enter, earned income includes all income from work, but only if it is included in gross income. … Earned income does not include amounts such as pensions and annuities, social benefits, unemployment benefits, workers’ benefits or social benefits.

Are pensions considered income?

Pensions. Most pensions are financed with Pretax income, which means the entire amount of your pension income would be taxable when you receive the funds. Payments from private and state pensions are usually taxable at your normal income, assuming you have not made any after-tax contributions to the plan.

Does pension count as gross income?

General sources of gross income include wages, salaries, tips, interest, dividends, IRA / 401 (k) distributions, pensions and annuities.

Comments are closed.